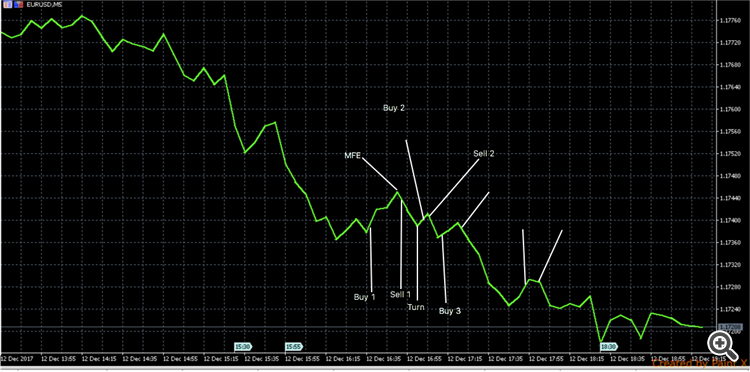

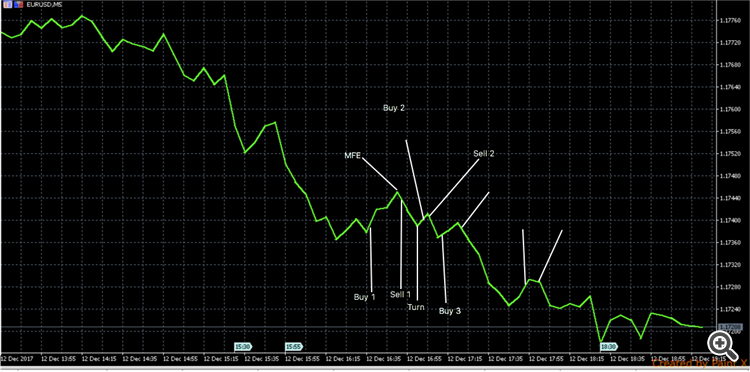

Lets say i Buy in at “buy1” The indicator will now calculate the difference between “Buy1” and “MFE”, 20% of that difference we can call X. When the price goes down from MFE, and the value of X away from MFE the indicator will Sell. The price then goes down to “Turn”, and starts to go upwards, when the price goes up the same value of X the indicator will buy in again and recalculate the new X. and keep doing the same thing again and again.

My question now is:

What is what i call “Buy1” called in MQL5 langue?

What is what i call “MFE” called in MQL5 langue?

What is what i call “Turn” called in MQL5 langue?

The programwill then be optimized with different other strategies. this is just a way i wanna try and calculate my stop losses and take profits.